Money: Developing a Spending Plan With a "Virtual Cookie Jar"

From what I can tell, very few people today have a spending plan, or budget, to manage their personal finances. I’ve discussed this topic with many people who are hesitant to even think about starting a budget because they believe they don’t have enough to make ends meet. But ignoring reality won’t make our financial problems go away.

From what I can tell, very few people today have a spending plan, or budget, to manage their personal finances. I’ve discussed this topic with many people who are hesitant to even think about starting a budget because they believe they don’t have enough to make ends meet. But ignoring reality won’t make our financial problems go away.

When things are tight, using a spending plan gives us the opportunity to choose the items we

truly need and are able to pay for and to make rational decisions about our spending so we can make ends meet.

The wide availability of credit, including balance transfers and deferred interest, has made managing finances even more essential. That’s because using credit makes it easy to spend more than we are earning. This can lead to a real financial mess! It is important to address this issue as soon as possible before we get over our heads in debt.

Many of you may have seen your parents or grandparents stash money away in a cookie jar or

envelopes to pay the bills. My wife told me how her mom used to take the cash from every paycheck and divide it into separate envelopes for family expenses such as food, utility bills and an offering or tithe for church. With five children in the family, things were really tight, but by managing the family income in this way, they were able to survive.

The idea of putting cash from our paychecks into a cookie jar or envelopes may sound old-fashioned, but the truth is that most people would be better off to follow this principle.

My family rarely pays cash for anything these days, so we have chosen to use another way to manage our finances—we use a “virtual” cookie jar. The principle is the same as using a real cookie jar or envelope system, except that we don’t use cash. Instead, we keep a record of how much money from each paycheck can be spent for each category. Here is how it works:

First, estimate your annual income and then divide it by 12 to arrive at your average monthly

income. This should include all forms of income, such as salary, pension, and investment income.

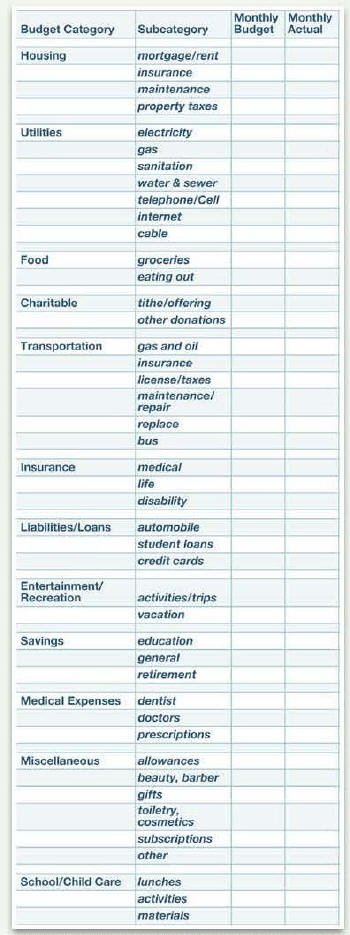

Next, write down all of your payments and “fixed” expenses. Fixed expenses are those that must be paid on a regular basis. These are different from “discretionary” expenses

such as food or entertainment, over which we have a greater degree of control. Examples of fixed expenses include a monthly mortgage payment or rent, car insurance, utilities, a commitment to charitable giving, and annual payments, such as for life and disability insurance. Estimate what your annual expenses are for each category, and then divide the total by 12 to calculate your average monthly fixed expenses.

Now subtract the fixed monthly expenses from your average monthly income. You are left with the amount you have for your discretionary expenses, such as food, clothing, gas, entertainment, savings, offerings and miscellaneous items. If your budget is like ours, then on the first pass of your spending plan, you may find that your estimated expenses exceed your income. To make it balance may require going back and cutting expenses in some or all of the discretionary expense categories. This process can be a real challenge, but is rewarding when you come up with a

spending plan that works.

What if your expenses greatly exceed your income and you just can’t make the budget balance?

Then you will need to find a way to increase your income and/or reduce your ongoing expenses. This may require making some difficult decisions, but there is no other option if you are to make ends meet.

| The idea of putting cash from our paychecks into a cookie jar or envelopes may sound old-fashioned, but the truth is that most people would be better off to follow this principle. |

Once you have managed to get income and outgo balanced, then your spending plan is complete

and you can begin allocating your income to the respective discretionary expenses categories. In these days of electronic deposits and on-line bill payments, it may not be practical to literally put cash into a cookie jar or envelopes. But the principle is the same. The idea is that each time you get paid, you should put money into each of the categories that you have designated. If you use a cookie jar or envelopes, then there should be enough cash to meet

your expenses when they come due. If you do this “virtually,” electronically, then the funds should be deposited into a bank account and you should track the amount for each category on a spreadsheet or in a notebook each time you make a deposit or expenditure.

|

|

In our family, we use a credit card for most of our expenses, but we pay the entire credit card balance off each month, so we do not pay any interest or fees. We make an effort to keep track of the expenses at the time of purchase, and then reconcile the expenses on our credit card statement after-the-fact to ensure that the spending for any category didn’t get out of hand. We also regularly transfer money from our checking account into a savings account to accrue for expenses that we have budgeted for but won’t be spending immediately, such as an annual payment or a vacation. In this case, our checking and savings accounts serve as our “virtual” cookie jar. As long as we are disciplined to not spend more than we have

budgeted in any category, then the spending plan works well.

Occasionally we have an expense come up that we didn’t count on, or we want to purchase

something that is not in the budget. This means that we will have to cut back expenses in another area, or use savings to cover the deficit. It is important to revisit your spending plan often—especially in times like these when inflation is causing certain items to rapidly get more expensive. Recently we made some adjustments in our budget to accommodate the rising cost of gas and food by cutting expenses in other categories.

As a family, we discuss our spending plan and include our children on certain decisions, such as how to spend our vacation and entertainment allotment. Also, we give our children an allowance and expect them to use it to pay for their own entertainment and toys. This has been a great teaching tool because they have learned to save money for things they really want.

Brent Baker has worked in the financial services industry for more than 22 years and is currently the Investment Services Risk Manager for a financial services company. He conducts seminars on responsible personal financial management. He is Assistant Pastor of Christ

Fellowship Church in Cincinnati, OH.

Author: Brent Baker